Equilibrium Infra Bulletin #55: Hyperliquid (and HyperEVM) ecosystem overview

Equilibrium designs, builds, and invests in core infrastructure for the decentralized web. We are a global team of ~30 people who tackle challenges around security, privacy, and scaling.

🔍 Hyperliquid (and HyperEVM) ecosystem overview

⚡️ Highlights

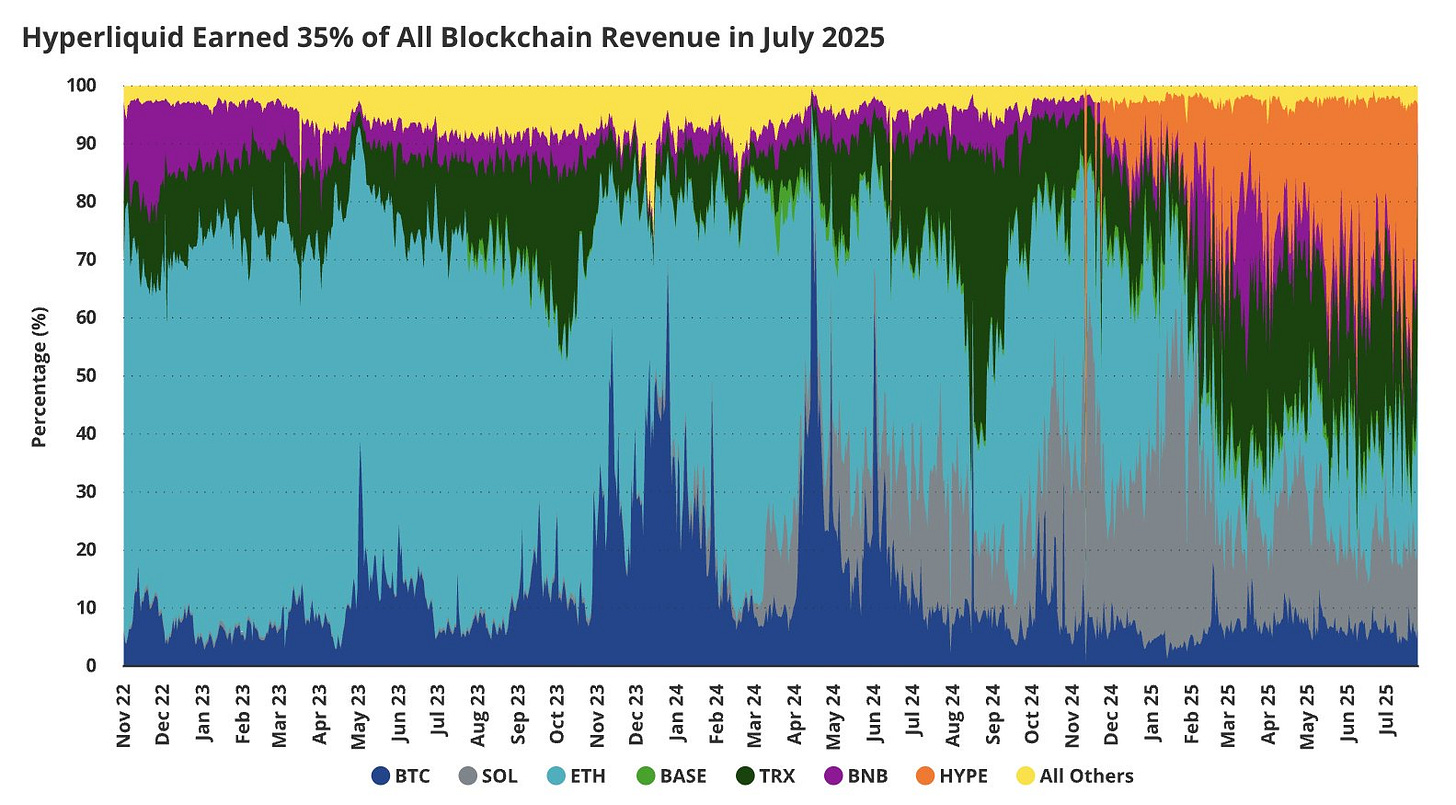

Hyperliquid has passed the most difficult test for a crypto project — getting initial traction and product-market fit. Last week, the protocol earned 35% of all blockchain revenue (L1 or L2), and its annualized profits exceed $1 billion.

Vertical integration has come to blockchain. It makes sense to “enshrine” an exchange protocol because that generates fees to HYPE holders. Similarly, Ethena’s appchain plans are essentially a roadmap for vertically integrating every valuable service — from exchanges and lending, to derivatives and prediction markets, tokenized assets, and more — under a single ecosystem.

Despite this, Hyperliquid is supporting an ecosystem of applications building on HyperEVM. Some of these services are directly “competitive” with Hyperliquid (e.g., exchange), while some offer complementary services (e.g., lending or liquid staking).

What the competitive dynamics end up being is a question mark — why wouldn’t Hyperliquid absorb every valuable use case built on its chain? Still, for projects looking for a home, there are only a few successful chains to launch on. Hyperliquid’s growing ecosystem and distribution might be your best chance of success.

Hyperliquid also offers unique features for projects to make money:

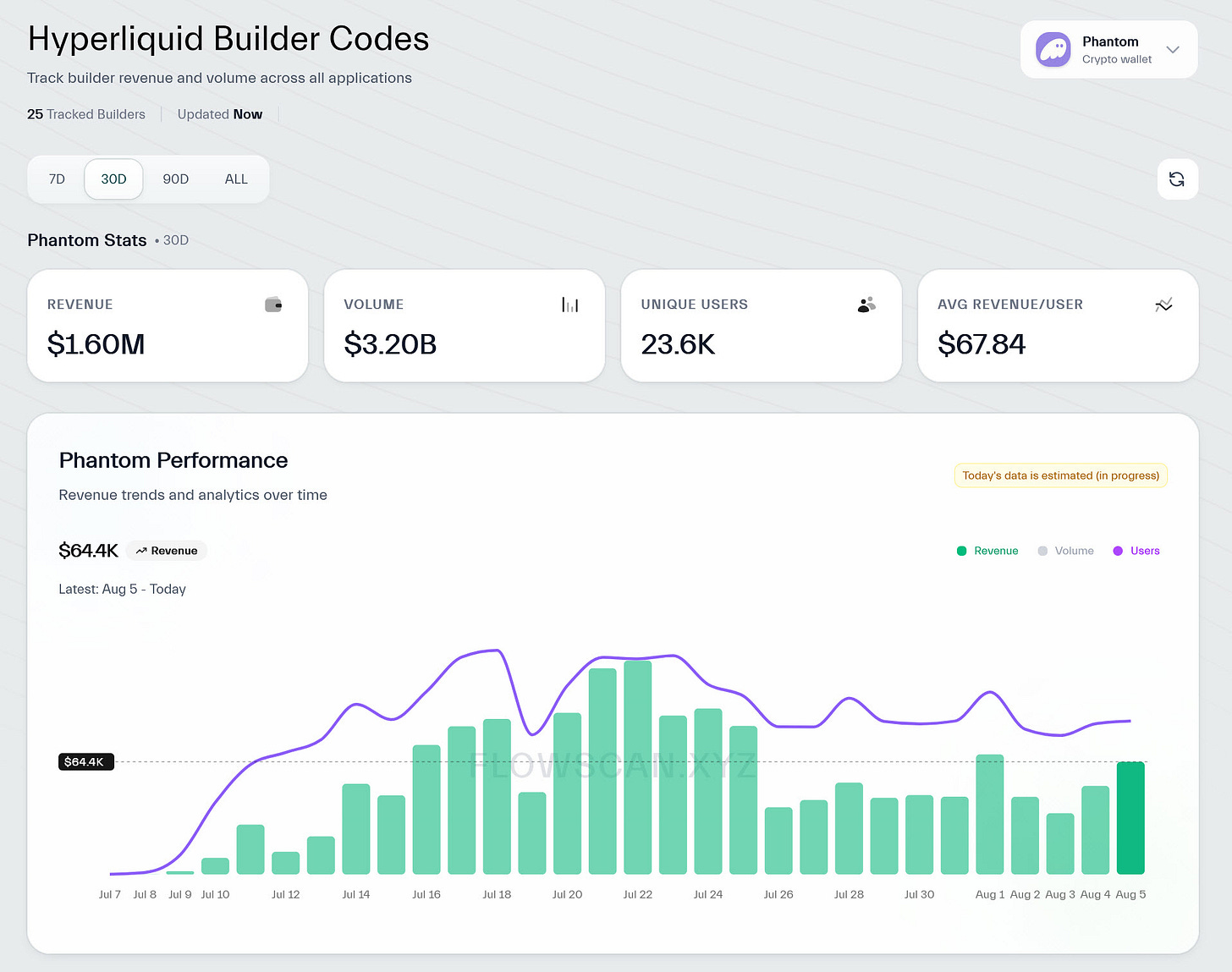

Builder codes — i.e., if you send an order to Hyperliquid, you make money. Phantom has already, in less than a month, generated $1.6 million in fees (on $3.2 billion of volume.

HIP-3 — i.e., create a perp market and if someone trades it, you make money. This is a future improvement that’s coming.

🤔 Ecosystem projects

Both builder codes and HIP-3 are good for monetizing existing customer acquisition funnels (like the Phantom wallet) or applications that can generate user attention. The most exciting opportunities on Hyperliquid are likely products that are able to now generate enough attention/capital to monetize via business expansion or new things that can really capture the imagination of traders.

Below are a few candidates for winners in the Hyperliquid ecosystem:

HyperUnit. The main bridge between EVM chains and Hyperliquid. Good network effect around assets — but also a business model that Hyperliquid itself could cannibalize.

Ventuals. In testnet, but has gotten a lot of attention for offering perps on private companies (such as OpenAI, SpaceX, Stripe, and Kraken). Mechanism design considerations and risks are plentiful (what’s the underlying price in edge cases?), but conceptually very cool.

HyperSwap. An AMM dex that’s pretty simple in design. However, right now, the secondary trading venue to Hyperliquid’s app, with expansion plans to mobile and HIP-3 markets.

In each of the main DeFi categories, there are a bunch of projects now with non-trivial TVL and volumes that could emerge as big winners. However, these are also areas where existing EVM protocols could emerge as tough competitors.

Liquid staking: Kinetic, stakedhype. Lending: HyperLend, Felix, HypurrFi. Trading: Valantis, Pear Protocol, Liminal.

💡 Research, Articles & Other Things of Interest

📚 It’s So Over: Crypto Treasury Vehicles (CTVs) Are Dying by DeFi Dev Corp. NAV premiums have been down-only for a month for crypto treasury companies. Will this continue and cause chaos in the market?

📚 American Leadership in the Digital Finance Revolution: Outline of the SEC's new initiative, “Project Crypto”. Arguably, the most bullish bit of text ever produced by a regulator for crypto.

🔥 News From Our Partners

🧙♂️ MagicBlock shipped their Magic Router to handle transactions between Solana and Ephemeral Rollups. Right now, dozens of teams are building on MagicBlock with “3 huge ones that I [the founder] can't mention yet”.

🫗Sanctum report by Delphi Digital. Sanctum LSTs are utilized by Jupiter, Drift, DefiDevCorp, MoonPay, and a host of other providers. 4th largest protocol on Solana by TVL, trading at ~$80 million fully diluted with annual earnings ~$10 million.

🤌 Personal Recommendations From Our Team

📚 Reading: The End of Everything: (Astrophysically Speaking) by Katie Mack. Most big picture popular physics novels nowadays tend to be a bit fugazi but Mack’s work is genuinely really good.

🎧 Listening: Dwarkesh Patel and Noah Smith on AGI and the Economy. Good discussion on what a world with AGI might look like.

💡 Other: A live-action Assassin’s Creed series has been greenlit by Netflix. Showrunner is ex-Westworld. Hopes are that it doesn’t suck because this IP is awesome. I don’t know how that Fassbender-led disaster was allowed.