Equilibrium Infra Bulletin #52 - The Tether Chain - How does Plasma work?

Reading the docs for Plasma so you don't have to.

Equilibrium designs, builds, and invests in core infrastructure for the decentralized web. We are a global team of ~30 people who tackle challenges around security, privacy, and scaling.

🔍 Zero Fee USDT Transfers w/ Bitcoin’s Security? - Plasma L1 Overview

⚡️ Topic Summary

You might have heard the commotion on CT this week around Plasma, a new L1 focused on stablecoins that has an investment and advisory connection to tether. The main narrative for the network seems to be that of challenging the massive amount of USDT volume on Tron, but in reality Plasma is also a fresh new L1 stacked with a bunch of new features. Here is an overview, based on publicly available info:

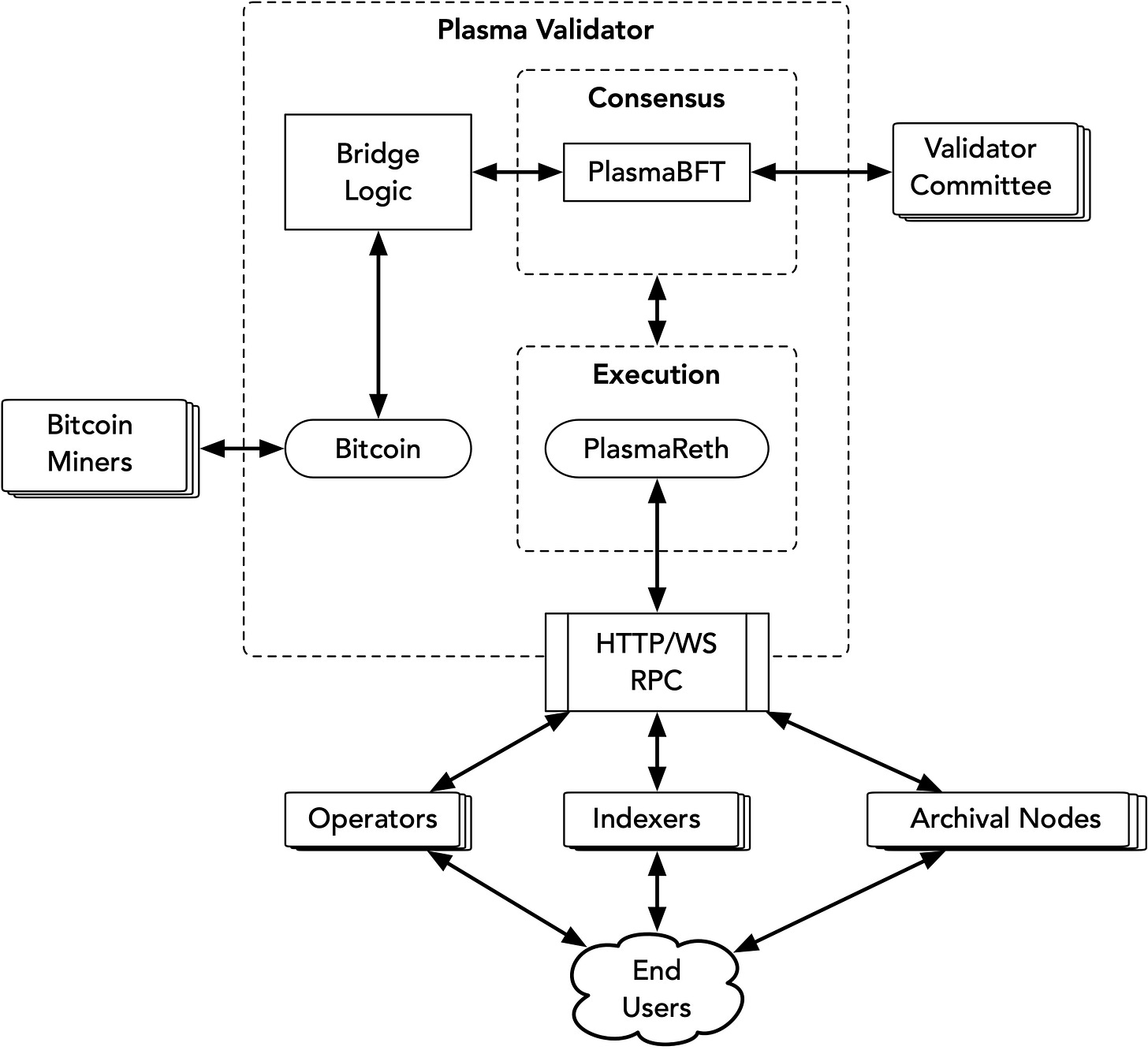

Reth-based execution for high-performance EVM equivalence

Fast consensus inspired by latest research, similar to Aptos and Sui

Stablecoin-focused features f.ex. a seperate transfer tx lane

Privacy features for stablecoin transfers

Native support for Bitcoin

Consensus

In their docs Plasma describes themselves to use something they call PlasmaBFT, which they say is based on the Fast Hotstuff. Hotstuff is the consensus protocol developed from original research at Facebook’s Diem project. The “fast” moniker just means that its a faster version of Hotstuff. To my knowledge there is no live chain based on this paper, so it would be the first in-production use of this protocol.

Plasma also aims to start with a Proof of Authority model. It will first be based on a committee, then over time expanding, and also at some point moving to a permissionless phase with Proof of Stake. This is probably because currently Hotstuff might still face slowdowns if the validator count is very high, and maybe also because of possible concerns of their zero free transactions causing spam.

🤔 Our Thoughts: Pretty standard these days - the research done at Facebook and continued at Sui and Aptos is pretty top of the class for consensus these days, and more and more other chains are inspired by it. We even have implemented a custom version of it for a client of ours. However it is still to be seen how well it scales when validator counts reach similar levels to Ethereum. They will probably also need to look at teams like Aptos for inspiration on how to handle this without slowdowns - for example via a reputation-based leader selection process.

Stablecoin Features

One of Plasma’s most unique features is its split-block architecture that enables its Zero-Fee USDT Transfers. Blocks on Plasma will be split, where one layer processes the EVM transactions, and another is focused purely on stablecoin transfers. This is not that different from something like Solana’s Local Fee Market, except here one market is always at 0 gas. The flip side of this of course is that there is nothing to stop spam, so the Plasma team mention multiple safeguards to prevent this:

Rate limiting - restricting the amount of times an account can use this 0-fee lane

Minimum balance requirements - requiring accounts using the lane to have an actual balance, for example of 10 USDT

An adaptive delay-based prioritization mechanism. What this probably means is that you can set some kind of “maxAcceptableDelay” for your transaction (maybe use of this is also restricted) and you tx will be included in times of less congestion, as long as its still in your max delay bounds.

They also mention something about private / confidential transactions, but there are no details of this anywhere yet.

🤔 Our Thoughts: I am not exactly sure if they have thought it through completely with the zero fee lane yet. It seems they have some ideas for anti-spam measures, but I am not sure if it is enough. This has been extensively studied in academia (Here’s a Perplexity search) and the consensus seems to be that it’s incredibly difficult and the most effective ways require some kind of reputation model. Maybe anonymous proof of humanity?

The Bitcoin Connection

For those that remember, Tether’s original implementation was built on top of Bitcoin too - it used a network called Omnilayer that stored data in the OP_Return output of BTC transactions. So it’s not surprising that a Tether-focused project would want to be deeply integrated with Bitcoin. Not to mention the position BTC now has, cementing itself as the clear no.1 asset that everyone wants to hold in some way.

For transacting with wrapped BTC on the chain itself, Plasma utilizes something similar to Polygon and Sui’s Ethereum bridge. Meaning the chain’s validators act as an MPC network for the mint and redemption of Plasma BTC. This also means all validators will need to run bitcoin nodes, and all actions will require a >2/3 consensus from the set.

Plasma has stated that the chain’s relationship to Bitcoin is similar to Polygon's relationship to Ethereum. Polygon calls itself a sidechain, but it is effectively its own Layer 1 that uses Ethereum for certain security functions. Similarly, Plasma claims it is a sovereign chain that leverages Bitcoin for security, but not a true L2 that inherits it.

Looking at their docs, their current implementation is focused on saving state diffs into bitcoin transactions metadata - specifically the witness data of a taproot transaction. This actually similar to how Omnilayer itself worked back in 2018, but instead of OP_Return, it is stored between multiple bitcoin Opcodes to ensure maximal amount of storage availability. This is similar to how bitcoin inscriptions work if you remember that crazy.

They also store a cryptographic summary of the current existing UTXOs as data into every plasma block.

🤔 Our Thoughts: The checkpointing idea seems to be more focused on data-availability and protection from long-range attacks, than securing the chain with Bitcoin directly. It is actually pretty reminiscent of paper from 2022 called Pikachu, which based on research from a team at Protocol Labs.

I am also curios why they want to compute and add the BTC merkle tree to every Plasma block. That is probably pretty huge amount of data (ChatGPT says 3GB with millions of entries). Additionally each time the UTXO set updates (i.e. transactions are confirmed), all affected leaves must change, requiring new proofs and tree recalculation. This overhead grows with UTXO churn. They should probably look at some kind of accumulator solution here.

💡 Research, Articles & Other Things of Interest

📚 How Stablecoins Become Money - A great summary of the actual challenges facing stablecoins currently. The article highlights how bank deposits are different from stablecoins, and how stablecoins and banks might become more similar over time. Bank will want to issue stablecoins that represent deposits in their bank, and stablecoins will want to have a more diverse set of collateral backing them. A hybrid future perhaps?

🤌 Personal Recommendations From Our Team

📚 Reading: Dungeon Crawler Carl - If you're looking for reading about doomsday stories of earth turning into a multi-level dungeon for intergalactic gameshow, a talking cat as a protagonist being an ass and shooting magic missiles from eyes, llamas and goblins fighting, epic boss battles, alien power struggles and politics etc - then this is the book for you.

🎧 Listening: Dialectic Podcast Ep. 17: Alex Danco - Innovation Begins with Gifts. Jackson Dahl’s latest podcast episode features legendary blogger Alex Danco, renowned for his insights on startup culture. In this conversation, Alex outlines his theory of gift-giving—the idea that framing creative work as a series of “gifts” rather than market transactions accelerates technology and innovation by resolving coordination failures.

📺 Watching: Uncovering Quake’s unseen collision hulls - Neat hack. They repurpose the visibility portal code in Quake to draw collision boundaries in-game, and show what causes some of the different collision bugs in the original Quake maps.