Equilibrium Infra Bulletin #50: Will Saylor (and his many copycats all) make it?

Equilibrium designs, builds, and invests in core infrastructure for the decentralized web. We are a global team of ~30 people who tackle challenges around security, privacy, and scaling.

🔍 Will Saylor and his many copycats all make it?

⚡️ Topic Summary

If you are in crypto, you probably have an opinion on Michael Saylor and (formerly Micro)Strategy. To some, he’s a genius who has figured out a loophole in shareholder capitalism, to others, he’s a nutjob running a levered strategy so ludicrous it will eventually destroy BTC itself.

Saylor’s playbook is getting crowded. Twenty One, led by Jack Mallers, is running a similar playbook now with Tether and SoftBank behind it. Nakamoto Holdings Inc. raised $710 million just earlier this week. Solana already has SolStrategies, DefiDevCorp, and Upexi running this playbook with large institutional backing.

This topic is one that’s often brought up, but most often lazily analyzed. In this post, we’ll be diving into 2 ways of viewing what Saylor is doing and what the result will be:

Saylor’s accumulation strategy in the context of crypto and financial cycles from a philosophical point of view — i.e., the theory.

The precise financing (debt or other instruments) details and how those will impact Strategy — i.e., the practice.

🤔 Our Thoughts

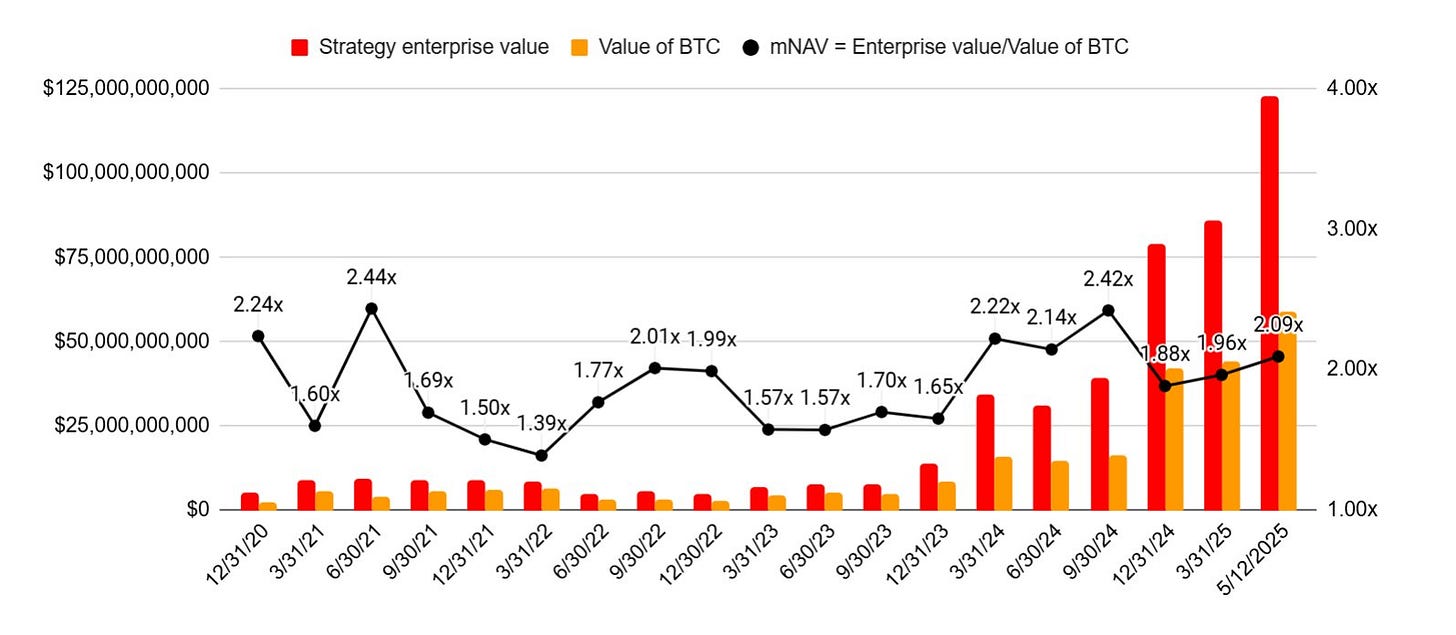

On the surface, the treasury accumulation strategies of Saylor and Co. do fit the bill for a classic “Hey, there’s a bubble” from The Big Short meme. Trading at ~2x above NAV that has assets (that may or may not be desirable going forward) attached to a middling business doesn’t make sense when you open an economics textbook.

But if we can work ourselves past the why or should a premium exist, the strategy itself begins to make a lot of sense. Trading at a premium to NAV (assuming no other value) does offer an opportunity for free money. Take the naive case:

A company has issued 10 shares each worth $100. Total market value is $1,000.

For simplicity, the company has no revenue or costs but holds $500 worth of BTC.

I, as a shareholder with 1 share, technically hold $50 of “real” value, but the market values it at $100.

The company issues 10 new shares for $1,000 (selling at market price) and uses the proceeds to buy BTC. The balance sheet now has $500 plus $1,000 worth of BTC.

I, as an existing shareholder, win because my shares were diluted by 2x, but my BTC holdings per share were 3x’d.

If the premium persists again post-sale, the company can simply run this again.

Strategy’s accumulation strategy is primarily built on convertible notes (debt). And while that is different than a pure equity sale, it fundamentally takes advantage of the same principle as described above — existing shareholders, and more importantly, Strategy’s balance sheet size, win at the “expense” of new investors.

Convertible notes are better because of the following attributes, though you do take on additional risk:

Raise cash with minimal or no interest cost (e.g., 0% or ~0.6% coupons).

Dilution only occurs in certain favorable conditions (if MSTR stock trades above the conversion threshold).

Attract traditional bond investors who might not buy pure equity but want some upside via conversion.

In practice, what you need to know about Strategy’s debt structure and how that influences the future:

The debt isn’t collateralized by BTC or high-interest loans. Thus, they don’t take on liquidation risks. Any unfavorable events are thus “paid out” by existing shareholders via dilution.

From now until 2031, a bit less than $1 billion annually rolls over. So as time passes, the current structure becomes more tenable each day, although Strategy does seem to want to add more going forward.

Solvency issues would only happen if BTC went below $10k (where the BTC value is higher than the debt), and at that point, crypto would be over anyhow.

More likely, if Strategy’s BTC reserves decrease in value significantly to the ~$30-40k per BTC range, it just becomes difficult to tap into capital markets to get more financing.

Thus, the most likely scenario in an extended bear market is simply that MSTR trades below NAV for a significant time — crypto has already run this trade once with Grayscale. And finally, a catalyst (pushing Saylor out or renewed optimism) gets investors out of the hole.

So what will happen with Saylor and his many copycats?

The answer is boring — it depends. Strategy didn’t have many issues in the last bear market, but it’s easy to imagine one of the various competitors taking this too far and ultimately blowing up. However, if one trades consistently at ~2x NAV and you don’t overdo the leverage, this is a very beneficial structure for shareholders (definitionally, by the mechanics involved).

From the macro financial philosophy POV, bubbles are a story of fundamentals with an added layer of financialization. In crypto, we’ve seen this with ICOs (public financing), liquidity mining (equity growth incentives), and whatever you call what the centralized lending platforms like Celsius, BlockFi, and Genesis were doing last cycle.

If you look at leverage today in crypto, it’s clear that the public-company-treasury-accumulation segment is the likeliest shot for the industry to point to in a few years as “OK, we might have gone a bit far there”.

If you look at other sources of leverage, there isn’t a robust centralized lending market anymore, funding rates and open interest on derivatives exchanges are pretty chill, and people aren’t jumping to finance the next idea blindly right now.

The scale of the leverage is also getting comparable. As these instruments (either on Bitcoin, Solana, or for another asset) reach >10% of supply, that becomes a significant overhang.

💡 Research, Articles & Other Things of Interest

🤓 TokenTreasuryTracker.com provides data on SOL treasury companies such as DefiDevCorp and Upexi.

📚 Multiverse Finance by Dave White from Paradigm. You get fun stuff from extending conditional tokens (pioneered by MetaDAO) into lending markets.

🎧 The Ultimate Coinbase debate: Can it survive? Coinbase has ridiculous fees on its products, and increasing competition in the retail market. What’s the bull and bear case?

🔥 News From Our Partners

Bullet (formerly Zeta Markets) is going through a slew of interesting updates and audits before mainnet launch.

Step Finance has bought back (and burned) a significant portion of its supply with revenues from its products over the past 2 years. Their latest product Remora, tokenized stocks, is launching soon.

🤌 Personal Recommendations From Our Team

📚 Reading: The hot hand in basketball: On the misperception of random sequences. Contributed to by Amos Tversky, Daniel Kahneman’s longtime partner in research. TLDR: hot hand doesn’t seem to exist, but then again, I’ve seen Klay Thompson score 37 points in a quarter.

🎧 Listening: But What is Quantum Computing? (Grover's Algorithm) by 3Blue1Brown. Familiarize yourself with quantum computing since BTC might get whitehatted by Google someday.